Striking a balance between self-sufficiency and the end game

Our experts debated the following issues:- What does the endgame for pension schemes look like when it comes to matching liabilities?

- How can schemes implement effective liability hedging in the current volatile macroeconomic conditions?

- What are the governance requirements around implementing an LDI strategy?

- How big a risk is inflation, how can schemes hedge it and should they target RPI or CPI?

- How can schemes make their matching assets work harder – i.e. blending LDI with other assets classes/strategies?

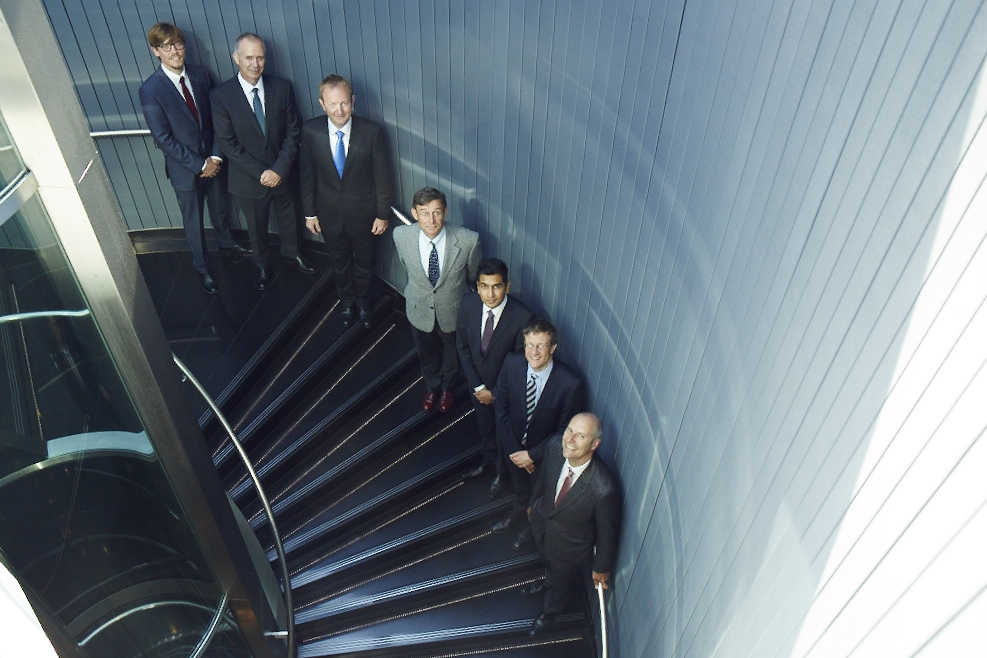

- Sebastian Cheek, deputy editor, portfolio institutional

- Robert Davies, partner and head of investment solutions, Quantum Advisory

- Mark Versey, chief investment officer – global investment solutions, Aviva Investors

- Giles Craven, chairman, Waterways Pension Fund

- Asish Doshi, associate investment consultant, Buck Consultants at Xerox

- Marcus Mollan, head of investment strategy, Legal and General Investment Management

- Jonathan Crowther, head of UK LDI, AXA Investment Managers