Portfolio Institutional: What does ESG mean to asset owners?

Mark Thompson: Managing environmental, social and governance risks is consistent with our fiduciary responsibility. So it is all about value and not values. As a result of that, for the last eight or so years we have been incorporating the management of ESG risks into our mainstream investment process.

Patrick O’Hara: It is an integration process. It’s about making better informed investment decisions, which hopefully will lead to better outcomes. This is helping fund managers to take advantage of opportunities associated with, for example, the transition to a lower carbon economy and managing the risks associated with that.

Faith Ward: We see ESG as a series of risks that might present an issue to investment returns. That could include political risk, which is why sometimes the coining of ESG can be somewhat limiting. You want to know if there are any risks that fall outside of traditional financial analysis that might have an impact on investment returns.

Being a new pool has massive advantages in terms of having a blank sheet of paper from which to work. We don’t have the legacy issue of having to change manager behaviour because we can go out and clearly say what we want from the outset.

PI: Are asset managers seeing a growing interest in ESG from their clients?

Ominder Dhillon: Yes. About 15% of the tender documents we received three or four years ago had a dedicated section on ESG; that number is now approaching 60%.

There is a lot more questioning, probing and attempts to get to grips with the underlying issues by clients, investment consultants and fund managers. This is an evolving journey for most pension schemes and their managers.

Lloyd McAllister: ESG integration is now standard; it’s almost negligent if you don’t do it. Some clients want traditional exclusion-based ESG, while others want ESG integration and to use the information set to improve shareholder performance. But the area where interest is growing for us is clients wanting sustainable funds to deal with negative externalities, such as market failures.

“You need to own the subject, to integrate it, not just have an ESG team.”

Nathalia Barazal, Lombard Odier IM

PI: Is the upcoming Department of Work and Pensions’ (DWP) rule on ESG disclosure behind this growing interest?

Anne-Marie Williams: We have seen a lot more interest from pension fund trustees wanting to understand their new duties. It has been on their horizon but they now realise that they need a proper investment policy for it. Then, of course, they will soon have to explain how they are implementing it and what they are doing on engagement.

All of those issues have meant that there is pressure to have something concrete rather than it being something they have been considering but not pinned down to a policy.

What we have seen is that if asset owners are not clear on their policies to their managers then ESG can get pushed down the agenda, particularly when trustees have so many priorities. So this is about pushing it to the top of the agenda.

PI: So regulators are playing a role in driving interest in ESG?

Williams: Yes, especially for smaller pension funds. HSBC has been looking at this for a long time and has a lot of knowledge and expertise, but for the ones that don’t regulation has made it clear that they have to develop a policy for it.

Ward: It has resolved the long-standing issue of whether investors, particularly trustees, are allowed to think about these things. “It is logical, but am I allowed?”

What the DWP has done, along with the guidance that’s come from the regulator, is to remove that ambiguity and make it clear that it is your fiduciary duty to consider such issues. Chris Varco: It is amazing how rapidly the fiduciary definition has gone from: “Could we?” To, “should we?” To, “we must.”

Chris Varco: It is amazing how rapidly the fiduciary definition has gone from: “Could we?” To, “should we?” To, “we must.”

Williams: It is the clarification that they can look outside of purely financial returns. When I started working at ShareAction four years ago I would often hear, particularly from smaller pension funds, that we cannot look at ESG because we have to concentrate on financial returns. There was no understanding of that if you take ESG risks and opportunities into account then you are going to improve your financial returns as well.

Ward: It’s a false dichotomy. There is a general recognition now that it is not an either/or trade-off. We have had so many corporate blow-ups, one after the other, in different shades, which have clarified that.

Varco: What has been positive is the step change from excluding bad things from portfolios to creating good things through impacting investing.

As we move to the materiality of so many sustainability factors, it’s the positive inputs to building a portfolio that will resonate. You cannot just be reactive to client needs and demands; you need to be more proactive. That is the real change I have seen.

O’Hara: If an issue is material and you are not giving it adequate attention in your investment process then it could be argued that you are not fulfilling your fiduciary responsibilities.

We also consider risks that are difficult to quantify financially over the short term that may impact the reputation of a business. We know child labour and modern slavery are not acceptable; we don’t need to demonstrate a financial downside. We see these issues as part of our stewardship responsibilities and integral to being responsible owners.

Thompson: The stewardship point is important. The whole investment chain has to work better. The DWP is making asset owners more aware of what they need to be doing, but they should get their fund managers to put pressure on the issuers of equity and debt to consider these things. Everybody along the chain has a responsibility to make it work.

There is an upside to stewardship from a policy perspective. We did some scenario work a while ago and looked at what would happen to our portfolio in a four-degree scenario; it’s not pleasant. The investment returns members were getting in that scenario were terrible. So it’s consistent with our fiduciary responsibility to stop that outcome happening at a policy level. It is not all just at the individual company level. Stewardship used to be defined as: “Has your fund manager voted?” It’s much bigger than that now.

“It is amazing how rapidly the fiduciary definition has gone from “Could we?” To, “should we?” To, “we must.”

Chris Varco, Cambridge Associates

Ward: We are supportive of the Financial Reporting Council’s definition of stewardship because it is more inclusive. It articulates the fact that financial institutions, companies, the economy and society are fundamentally interdependent.

I am hoping that definition will survive the onslaught of pushback, which it will inevitably get because it’s pushing the boundaries of what people are used to. It is perhaps changing their world view, but I believe the Financial Reporting Council have got it right.

PI: Once you have set an ESG policy, what are the challenges of implementing it?

Nathalia Barazal: Fiduciary duty starts with the asset owners but it goes through to the fund manager. It starts with risk mitigation, drawdown management, capital preservation and reputational risk. Clients are no longer passive. They are now an integral part of the investment story.

It is not just focusing on what’s right but also what’s the impact for investors, negative and positive. This is more of a sustainability evolution than revolution because our role is to raise awareness of best ESG practice. There is still confusion and many non-believers, but regulation is clearly moving in the right direction.

When it comes to stewardship, I manage bonds and so I cannot participate in votes, but this has changed massively. We have sent emails to companies in China and within a few hours the CEO answered our list of ESG questions. There is clearly a new level of awareness about this issue. So there has been a bit of pushback, but I am pleasantly surprised that everybody is on the same path and feels that they have to change. Stewardship is the way to get more power. Everybody is responding positively because there’s an accountability that was not there a few years ago. It gives our voice more weight.

“Engagement is a long game, but it is going to become increasingly shorter and that’s partly due to reputational issues quickly percolating through social media.”

Ominder Dhillon, M&G Investments

Williams: It is important within stewardship that asset owners hold asset managers to account and that asset managers hold companies to account. You also need robust engagement with an escalation strategy if it’s not working. So having real engagement with teeth and not just talking about good stewardship, but voting on resolutions and, for example, disclosing a rationale for voting on controversial issues. There is a lot of transparency and active ownership because sometimes people say things and don’t follow it through in terms of voting on important resolutions.

Ward: I would add investment consultants to that mix of accountability. They have so much power, particularly in the UK. The smaller the fund the more dependent it is on the skills and competencies of investment consultants.

Varco: A lot of investment consultants have depth in this area. They have ESG specialists finding ESG funds and working with ESG-focused clients.

We have done a lot of work in systematically enhancing the amount of ESG institutional data we collect across asset classes. That’s a lot of education for our colleagues doing hedge fund research because they are not used to asking questions about engagement. If you have a client that’s taking this seriously, it comes down to what your adviser is doing in that space. That’s an area that was a massive enhancement for us in 2018.

PI: Engagement has been discussed quite a lot here, but how important is it?

Thompson: The ESG debate has moved on in the past 10 years. It’s less about exclusion and more about engagement now. Engagement is part of stewardship, but it has to be engagement with teeth. You have to properly engage.

An important part of our core DC portfolio, apart from having some climate tilts to reduce the carbon footprint, is the engagement policy. We wrote to the chairs of the 84 largest companies globally to warn that if after a year of engagement they have not put any decent plans in place, the fund manager will vote against your re-election.

We threw eight companies out last year, so it had a good impact in terms of behaviour.

“It is important within stewardship that asset owners hold asset managers to account and that asset managers hold companies to account.”

Anne-Marie Williams, ShareAction

Ward: There is a difference between disinvestment and decarbonisation. Decarbonisation is about making more nuanced choices within sectors and then engaging with the companies that recognise there needs to be a change. They may be high carbon emitters now, but it is about what’s going to happen? What’s the direction of travel? It is a more forward-looking scenario.

Varco: I agree on the basic economics for having less fossil fuel emitters in your portfolio, and it’s amazing how to some extent the market is discounting this.

If an active manager bought a basket of energy equities at the low point of the oil price in March 2016 and rode it all the way up to the high point last October, the price of oil increased 155%. You would think that the manager who bought a basket of oil equities at that low point would be a hero but MSCI Energy underperformed MSCI World. That tells you that people are looking at the long-term risks.

Williams: That’s what makes the engagement so crucial. It is not just a question of looking at green companies as opposed to brown. You are looking at companies that are making the transition, like a car company that might be switching to producing electric cars; you would want to own that. So you would want to exclude high-carbon companies, but what’s crucial is identifying the ones that are going to successfully make the low carbon transition.

That is where engagement comes in because without robust engagement you are not going to be able to select the right companies to tilt your portfolio.

Barazal: Engagement gives you a qualitative view on certain data. When you look at ESG ratings you question the quality of a lot of this data. It is not financial information, it’s not audited.

ESG is part of the story but you need to question it, you need to ask: “What does it mean? Where does that company come from? Where is it heading?” With engagement you can have a view on the future and help these companies to move in that direction. That is very powerful.

O’Hara: Many of these companies have a big contribution to make in managing the low carbon transition and developing the technology that’s required. There is a positive impact that you are having through these investments.

Barazal: They are all part of the economy. Some of them will disappear but most of them need to be part of the transition.

Ward: I co-chair the Transition Pathway Initiative, which is designed to support that process. It is a tool that looks at carbon intensive sectors, what they have disclosed and how transparent they are. It helps identify where companies are going as much as where they are now. It is important to differentiate between those who are being responsible and those who are not engaging in this debate to help us make informed investment decisions.

O’Hara: One of the good things about the Transition Pathway Initiative is that smaller asset owners, that do not have the budget for a dedicated ESG person or cannot access detailed research, can use this tool; it’s free, there is a robust methodology behind it and it was built in consultation with asset owners with the needs of asset owners in mind.

“We did some scenario work a while ago and looked at what would happen to our portfolio in a four-degree scenario; it’s not pleasant”

Mark Thompson, HSBC Pension Scheme

PI: Does engagement work if you are a smaller scheme?

Williams: Collaboration is key. Climate Action 100+ is a good illustration of that, particularly for small asset owners. If they collaborate they have a bigger voice than if they go in as an individual.

Ward: You can see changes happening at Shell, for instance. There’s been quite a substantial push from investors around transparency. That is a massive shift.

O’Hara: Yes, Shell’s approach to climate risk, announced in December, is ground breaking. Investors have been engaging with Shell for 20 years so engagement can be a long game and change can be incremental, particularly in developing markets where some companies are just getting used to engaging with investors on ESG issues.

PI: Is there a difference in attitude to engagement between UK and US-based companies?

Ward: There is definitely a geographical difference. In broad terms, there is more responsiveness from European-based companies.

There are challenges with some of the newer US companies, particularly in tech, which don’t seem to be quite as responsive to shareholders. They are delivering returns and that seems to be where they want to take the conversation.

Dhillon: When some companies are floating they create interesting shareholder structures with voting and non-voting shares. That is something that we look at quite hard before plunging into particular transactions. It is slightly concerning because they are creating a structure that potentially makes engagement harder.

Engagement is a long game, but it is going to become increasingly shorter and that’s partly due to reputational issues quickly percolating through social media. So we have to be careful of companies that are issuing dual shareholder structures.

Thompson: We tend to be pretty good at the governance part. When I first started in the City 30-odd years ago, the ‘G’ bit was all the focus.

Dhillon: On the ‘S’ bit, when we mention cyber security people think of data privacy. That is something that’s going to be increasingly brought to the fore. Data privacy has been written about within Silicon Valley for a decade. One could have got ahead of the curve on this by being part of the right conversations.

Williams: Also on the social side, at ShareAction we have something called the Workforce Disclosure Initiative, in which there has been a lot of interest. It has 13 investors with more than £13trn of assets under management.

There has been so much interest in getting companies to disclose data, particularly in their supply chain. Multi-national companies sometimes may not know what’s going on in their supply chain, so they are grateful to us for setting it up because that’s given them the opportunity to investigate what’s going on.

We send a comprehensive survey out to companies that cover health and safety, turnover, gender, training, areas where up until now the data has been poor.

There has been a lot of interest in that initiative and it’s going from strength to strength because there was such poor human capital data and that is a risk. So you can get a lot of people onboard in a neglected area.

Varco: The investment community in the US is ahead of Europe on gender and diversity. We hired a senior director to look at those metrics in managers and their underlying holdings.

Ward: Those metrics are not necessarily driving diversity though, are they?

Varco: No, that’s the challenge. Ward: It is interesting to get feedback from the beneficiaries as to where their interests and concerns are. Climate change dominates and executive remuneration is regularly on the list of enquiries, but last year was the first time I had a stakeholder enquiry about how we look at sexual harassment in terms of engagement.

Williams: At LAPFF’s conference last year a worker from Tesla talked about the company’s working conditions. It was quite shocking; he was almost killed. Investors have become much more interested in those areas.

Ward: When I do trustees’ training, they usually ask me what the perfect company is. My reply is always: “I’m still trying to find one.” This is said with a smile, but the serious point is that managing these issues are a complex set of challenges for companies.

McAllister: Nothing is black and white. Mining for cobalt is where the best money is to be made in the electric vehicle value chain, but you are getting into child labour in the Democratic Republic of the Congo (DRC). Then you are weighing up the net impact of helping to reduce air pollution versus child labour. These are difficult decisions and it’s where engagement can make a real difference. It is far better to own and engage and change than to walk away.

We met a company in the electric vehicle value chain and it has since changed its incentives for mine owners in DRC and created education programmes on the ground. That is the real change that comes from investor engagement. It is murky and is not black and white, but it has to be done and it takes time. Ending child labour in DRC is not going to happen anytime soon, but what you can do is make small incremental changes.

Dhillon: Has that been improved by more precise measurability? This is one of the things that worries me slightly. There’s a bit of a balancing act where taxonomy is required along with some element of measurability.

Going back to the question on how does one integrate it if you are a mid-sized scheme that does not have the internal bandwidth to wrestle with these issues? We are in the business of investing and making sure beneficiaries receive their benefits. So there’s a drive to make sure this stuff is measurable, and then you come across these murky, grey, slightly complicated cases, of which there are a lot. So how is my ability to drive positive improvement improved by evermore precise and spurious measurability? I don’t have the answer but it is a dialogue that we tend to have with clients because you are going to struggle to eliminate child labour in places like India. It is part of the economic fabric of some of those villages. It is an issue that’s difficult to address.

Varco: I worry that there are industries and companies that for engagement there’s no end product, such as tobacco.

O’Hara: There is a point to engaging with tobacco companies. Tobacco is an agricultural industry, it has child labour in its supply chain and it uses a lot of water. Like any other business they have impacts and a footprint. You are not going to stop them being tobacco companies, but if they are in your portfolio you can encourage them to manage their business’ more responsibly and you need to ensure that corporate governance issues are flagged and addressed, as you would with any company in your portfolio. Health and safety standards in some plantations are unacceptable and exploitation can occur, by engaging with tobacco companies and encouraging them to exert their influence down their supply chains you can make a difference to people’s lives.

“We know child labour and modern slavery are not acceptable; we don’t need to demonstrate a financial downside.”

Patrick O’Hara, USS Investment Management

Thompson: Exclusion happens on two levels. One is that a trustee wants to exclude something from the portfolio.

If you are excluding something on non-financial grounds then you have to be confident that the majority of your membership feels the same. You must also ensure that by excluding companies you do not have a negative material impact on the portfolio’s investment performance.

The second level is if the fund manager, as the fiduciary, decides that they don’t want to invest in tobacco, for instance. They have weighed up all the points and found that it is not viable as an investment.

Williams: It also comes down to whether the engagement is successful. The ultimate aim is to change a company’s behaviour but it might come to the point where you realise that it is not working and will have to decide when to walk away. Aviva, for example, is assessing 40 coal companies to see if they are going to transition or not. If they cannot see enough change then it will divest.

PI: We are talking a lot about equities but debt is a big part of institutional portfolios. Outside of green bonds, what’s available?

Thompson: It is about how you incorporate the management of ESG risks into any bond portfolio. That is the ESG risk mentality but as soon as you start talking about the green bonds part of it you put yourself into a slightly different bracket because you are investing for purpose.

Barazal: Green bonds could seem the most obvious route in this sustainability revolution, but in most fixed-income strategies, it is now possible to implement ESG or risk mitigation factors into the process. Sometimes when you look at sustainability risk you might think that it’s more important in an equity investment because one imagines ownership as open-ended, whereas in a bond what you care about is getting your money back at maturity. Volkswagen was in the middle of a huge scandal, but it could pay back its bonds. Duration risk is important for owners of long-term bonds. In that sense, the risk is the same. Three years is easy, but when a sector has been disrupted who knows if that company will exist in 10 to 15 years’ time. That is the question you need to answer before investing. So it matters.

The biggest challenge in fixed income that I hear when talking to clients is: “Prove to me that they don’t have a negative impact on performance.” I hate that question because it is backward looking. This is an interesting time, a kind of awareness revolution, which has an impact on the way a company will be judged and challenged. We need to take that into account in all of our portfolios.

“ESG integration is now standard; it’s almost negligent if you don’t do it.”

Lloyd McAllister, Newton Investment Management

Varco: It’s good to hear that you are seeing that. Having met pretty much every bond manager creating an ESG product, I guess it’s normal for them to think that they are reacting to client tastes or a marketing opportunity.

Many bond managers don’t believe what you are saying. They will always anchor back to bonds gravitating to par or Exxon Mobil may have trouble in 30 years time but they are going to repay their senior debt next June.

Thompson: You just said: “…an ESG product.” I don’t know what an ESG product is. I would never buy an ESG fund; I want to buy a fund that incorporates ESG into the investment process.

Varco: From multiple managers there have been a plethora of ESG-labelled bond products. I have not come across a proactive way of naming it in fixed income as we have in equities. Thompson: At one level it is simple. How do we incorporate the management of ESG, including climate change risk, into the credit assessment of an issuer?

McAllister: We get our fixed income analysts to do the ESG analysis now. There is no separate responsible investment team. They do the analysis before it comes to our team. We review it, then it goes back and slowly the review points are going down and down and down and down.

Ward: That is an integrated model we would be looking to procure. Then people in your role are picking up the emerging risks or things that are coming perhaps slightly leftfield into an area that’s managing these risks, which is where something like cyber security comes in and where companies of all sizes and sectors are finding themselves impacted.

McAllister: I love it when we see a fixed income investment note that automatically includes ESG. Our team just absolutely loves it because that’s what integrated ESG should look like. It is not a separate issue.

Williams: It is important to have it joined up across all asset classes. ShareAction recently produced a report on what corporate bondholders were doing to address climate change. We found that while most accepted that climate change is a risk and were acting on it, we saw little appetite for collaboration between them and equity owners. It would be good to see more active engagement because there you have a lot of power. This is particularly true for passive investors who cannot divest on the equity side but can use their bondholdings as leverage when the refinancing comes up.

Barazal: It is power in numbers. It is also challenging; you can’t vote. You need to own the subject, to integrate it, not just have an ESG team. Credit and equity analysts need to look at the risks and the opportunities of sustainability in whatever trend or metrics we are talking about.

Dhillon: It is complicated. For several months we have been work-shopping with our equity and credit analysts to look at a common “lens” for each sector. This would help create a co-ordinated ESG perspective and then use that to engage with companies. We do not have a single perfect answer. This is a journey for most managers, but that’s absolutely where some of the focus needs to move to. We are working through these issues about how to join both sides of the balance sheet to come up with a more powerful approach to ESG engagement using what we do across equities and credit.

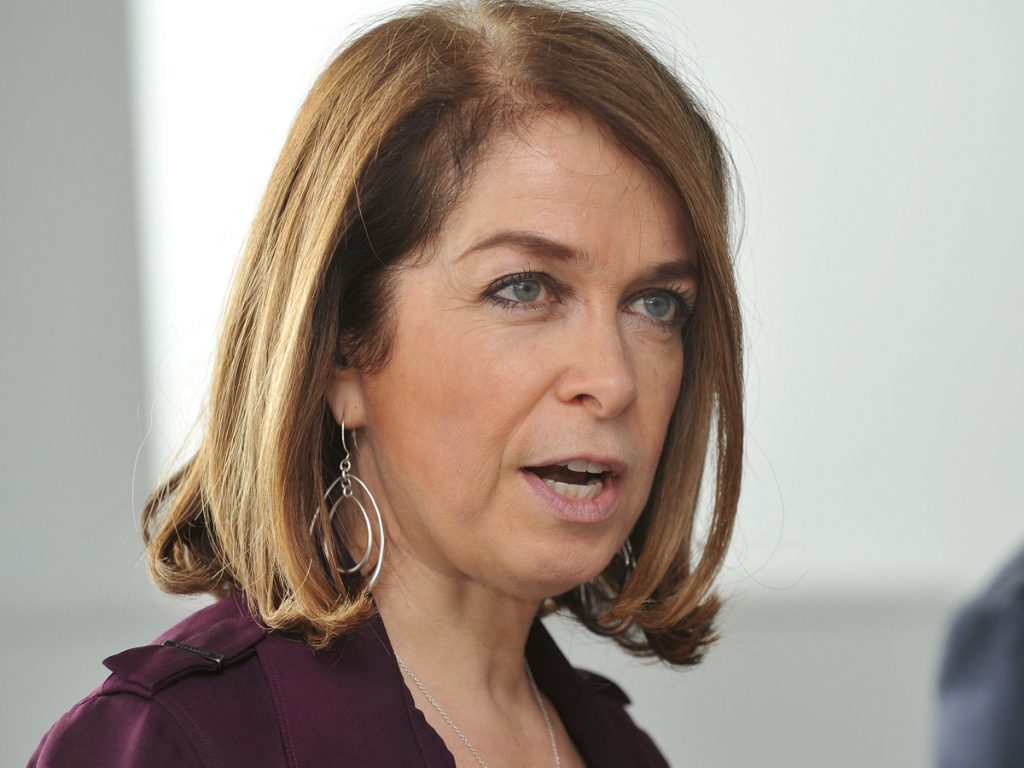

“Climate change dominates and executive remuneration is regularly on the list of enquiries, but last year was the first time I had a stakeholder enquiry about how we look at sexual harassment in terms of engagement.”

Faith Ward, Brunel Pension Partnership

McAllister: A lot of this discussion has been risk focused. Our sustainable funds have themes like sugar reduction and there’s a bunch of investment opportunities coming up off the back of other such sustainable trends. That is where I find it transforms a conversation from: “We don’t like this,” to, “we like this”. It is trying to be defined by what you hold rather than what you don’t. That makes the conversation more positive.

Ward: That is where the SDGs have been a helpful framework in identifying positive themes.

Williams: It is also a useful for measuring impacts as well.

Barazal: When we talked about ESG 10, 20 years ago it was about scaring people. Today everybody owns the story because they are conscious of it. And it is not just about looking at the risk but also making the most of this opportunity.

This helps getting a more fruitful way to engage with companies and just as importantly with all investors in a dialogue about best practices and their impact of stakeholders.

Kindly sponsored by: