The huge growth in private equity and venture capital investments in the consumer sector has continued into this year, says one market watcher.

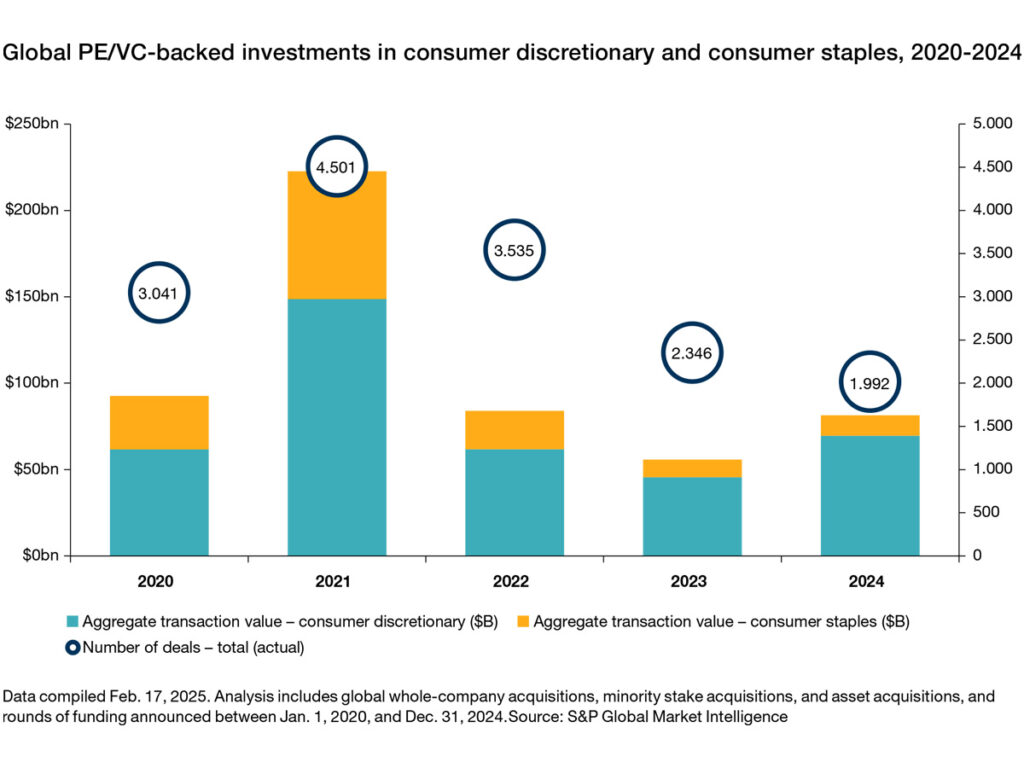

In 2024, the value of deals in the sector jumped by more than 45% to $81.4bn (£64.5bn), according to research from S&P Global Market Intelligence.

In January this year, 136 deals involving consumer companies were completed for a combined cost of $720m (£57.1m), which the research claims is a sign of momentum in the market.

The sector is traditionally characterised by changing consumer demand, strong competition, sensitivity to the economic cycle and supply-chain issues.

However, private equity and venture capital firms see an opportunity to invest in consumer brands to align them with popular areas of the market.

Rising consumer spending and stronger job figures in the US are making distressed consumer brands more attractive.

The research found that corporate carve-outs of specific consumer units are proving a particularly popular strategy among private equity firms.

Last year, buyouts at companies offering non-essential goods and services totalled $69bn (£54bn), which was around 52% higher than in 2023.

Consumer staples saw a slight increase during 2024 to $11.8bn (£9.3bn) from $10.2bn (£8bn) in the previous 12 months, as economic con dence returned and interest rates appeared to be more stable.

On the discretionary side of the sector, education was the most popular being at the centre of 133 deals worth more than $17bn (£13.4bn).

But most of this figure came from the world’s largest private equity-backed consumer deal of last year, which was the Canada Pension Plan Investment Board, EQT Private Capital Asia and Neuberger’s $14.5bn (£11.5bn) takeover of Nord Anglia Education, a London-based school operator.

After education, car makers saw the second highest deal flow at $11.9bn (£9.4bn) across 51 deals, ahead of casinos and gaming at $7.2bn (£5.7bn) in 18 deals.

Comments