The Bank of England’s (BoE) November interest cut to 4.75% – the second reduction this year – was met with calm from investors, while offering some opportunities.

“Gilt markets have taken the BoE’s decision to cut rates by 25 basis points in its stride, with little market reaction,” said Mohammed Kazmi, chief strategist and senior portfolio manager at UBP.

“This comes in stark contrast to the price action observed over the past couple weeks given the event risk that came from the domestic budget and the US elections,” he added.

Kazmi also observed that while the bank significantly raised its growth and inflation profile for the UK in 2025, as a consequence of the budget, much of this was already in the price given that the market expects the BoE to cut rates to the highest terminal rate within the G10, at around 4%.

The situation does though present bond opportunities.

“With government bond yields globally having now corrected over the past month towards more reasonable levels and credit spreads continuing to find support from the soft landing back-drop, we believe it presents an opportunity for investors to take advantage of the attractive yields on offer within the asset class and with the election clearing event having now passed,” Kazmi added.

Bullish voices

In this environment, he has a “preference for the higher income segments of the market, such as high yield, as we anticipate for the default rate cycle to remain benign and the AT1 market given robust banking fundamentals.”

There can be no doubt that Rachel Reeves’ budget hung over this rate decision, and possible future decisions to come.

For Laith Khalaf, head of investment analysis at broker AJ Bell, the prospect of more cuts is no longer clear. “The market is still pricing in another [UK] rate cut either in December or February, and then another one by May 2025.

“There are some more bullish voices out there, including Goldman Sachs who have forecast the UK base rate to fall to just 2.75% by next autumn. The fact the decision to cut rates was almost unanimous will put some powder in this argument,” Khalaf said.

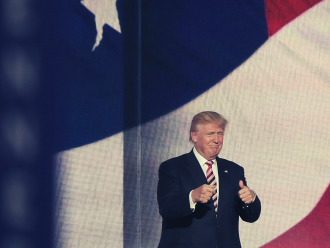

“But if Donald Trump pushes ahead with a restrictive trade policy, that would really put the cat amongst the pigeons when it comes to UK inflation and interest rates.”

Cut acceleration

Although ING developed markets economist James Smith predicts the BoE will have managed six more cuts by next autumn. “If services inflation continues to fall more meaningfully next year, as many of the surveys seem to indicate, then we are still likely to see rate cuts accelerate,” Smith said.

“Remember, markets are pricing fewer than three rate cuts from here on in,” he added. “That would leave UK rates more than two percentage points above the European Central Bank in a year or so.

“We don’t think that sounds particularly realistic. Our view is that rates will be cut at every meeting from February until they reach 3.25% next autumn.”

And Jamie Niven, senior fund manager at Candriam, warned: “We continue to believe that, certainly on a relative basis, market pricing for the terminal rate [the long-term target] in the UK is too high.”

In its announcement, the bank said the chancellor’s £70bn of additional spending, backed by higher taxes and borrowing, is expected to add about 0.5% to headline inflation and 0.75% to gross domestic product.

Research group Capital Economics wrote in an investor note: “While cutting interest rates from 5% to 4.75%, the Bank of England implied that the Budget means rates will continue to fall only gradually.

“We agree and due to the Budget, and not the US election, we have concluded that rates will fall slower to only 3.5% in early 2026 rather than to 3%. This still implies that rates fall below investors’ expectations of a low of 4%.”

Unknown risks

But for Michael Metcalfe, head of macro strategy at State Street Global Markets, what was most interesting about the bank’s statements was what was missing.

“The BoE’s projections are based o market implied interest rate assumptions taken in the second half of October, so before the Budget, but they still saw inflation falling to target,” he said.

“The implication is that market move up in interest rate expectations since the Budget is excessive and that more cuts are possible. A tendency that will only be further encouraged if another risk not noted in the November policy report, a US universal tariff on exports, is realised,” Metcalfe added.

Ahead of the BoE’s next rate decision, a range of data focusing on different areas of the economy will become available for investors and others to make a call on the wider economic situation.

“We will get multiple growth, inflation and labour market reports to watch ahead of the Bank’s December decision,” said Sanjay Raja, chief UK economist at Deutsche Bank.

Comments