While few dispute the continent’s long-term prospects, investors are likely to need steady nerves and patience before reaping the benefits, Lynn Strongin Dodds finds.

“Lower commodity prices are difficult for Africa because many countries that were booming have some kind of commodity underpin, either currently or planned for the future.”

Rory Ord

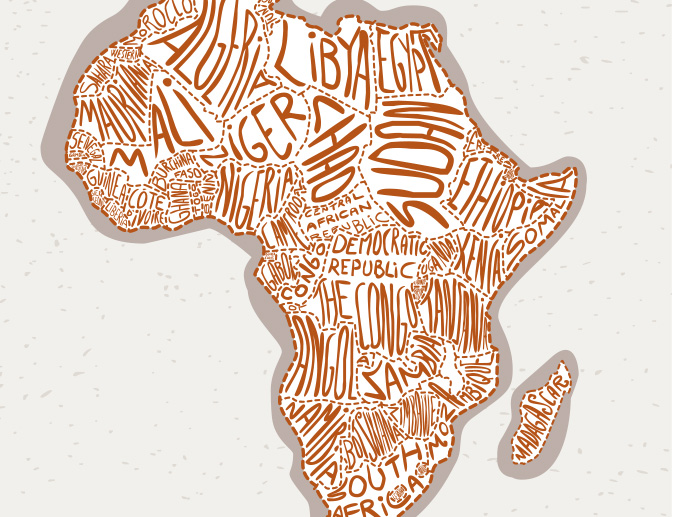

Speaking at the National Association of Pension Funds conference in October, Sir Bob Geldof, musician, activist and entrepreneur encouraged institutions to shift their focus from China to Africa. Many were already moving in this direction but had reversed their positions this year due to the Ebola virus in West Africa, weak commodity prices and armed conflicts in Nigeria and Kenya.

While few dispute the continent’s long term prospects, investors are likely to need steady nerves and patience before being able to reap the benefits.

For now, nervousness presides. Figures from data provider eVestment show outflows of $38.1m over the second quarter from its All-Africa Equity universe after the Ebola crisis first hit in March. Sentiment though has been bearish for a while with investors withdrawing money for five consecutive quarters. This is in contrast to the overall exponential growth of institutional assets under management to $24.1bn as of 30 June 2014, up from $267.1m as of 30 June 2008.

“There have definitely been a few headwinds with Ebola, the terrorist group Boko Haram and lower commodity prices having had a significant impact on earnings, growth and sentiment,” says Julie Dickson, EM equity portfolio manager at Ashmore Investment, a specialist emerging market fund management group. “However, we think things will settle down and that markets will come back. If you look at the year to date figures for Frontier Africa, which is based on a customised benchmark, it was up 6% to 8% compared to 4% for the whole emerging market index. There is definitely upside potential.”

Although the Ebola outbreak has been devastating on many levels, the World Bank expects the impact to be mainly limited to three countries who together only account for about 1% of the total gross domestic product (GDP) of sub-Saharan Africa. Sierra Leone is suffering most, with the Bank recently slashing its growth estimates from the pre-Ebola projected rate of 11.13% to 4% while Guinea will also experience a decline to 0.5% this year and -0.2% in 2015 from 4.5% before the virus took hold. Meanwhile Liberia’s economy will slow to 2.2% this year from the 5.9% pre-outbreak forecast but it should rebound to 3% in 2015 as the virus is abating.

The situation has been exacerbated by falling commodity prices. The S&P GSCI has dropped by over 20% since its June peak this year which has hurt many countries that are reliant on one commodity to drive growth. Even before Ebola, Guinea, Liberia and Sierra Leone were hurting from depressed iron ore prices while declining copper prices put a dent in Zambia’s bottom line. Oil rich countries such as OPEC members Angola and Nigeria are particularly feeling the pinch from Brent crude plunging 40% over the past six months to $68 a barrel. Analysts’ forecasts predict an average of $65 in 2015 and $70 for 2016.

The result is that Angola could face its first budget deficit since 2009 as export revenue drops, while Gabon’s growth will slow next year, according to the International Monetary Fund (IMF). Nigeria, the region’s top oil producer, is feeling the most pain. It has recently toppled South Africa from its perch as the largest economy and while it is more diversified than in the past, the country still derives about 70% of government revenue from oil exports.

One of the main issues is that the government did not save during the good times. A public fund that contained $20bn in oil proceeds when crude prices first surged past $100 a barrel in 2008 has shrunk to $ 4bn as of November. Foreign reserves have also tumbled to $36.7bn, the lowest level since August 2012 while the currency, the naira, slumped to 180.18 to the dollar in early December, extending a slide that has shaved more than 10% off its value this year.

Comments