As society in general has become aware of the need to decarbonise the economy and the way we live, investors have been considering how they should respond. Such a transformation will require massive investments in new assets while making others obsolete or impermissible. It will require new technologies and business models to be rolled out. Institutional investors have a pivotal role to play in this reallocation of resources; their motivations can and should be twofold:

- The social imperative to contribute to this change

- The investment imperative not to be caught on the wrong side of history

A holistic portfolio response to climate change must address:

- What you don’t invest in

- What you do invest in

- What you ask of the companies (and managers) you invest in

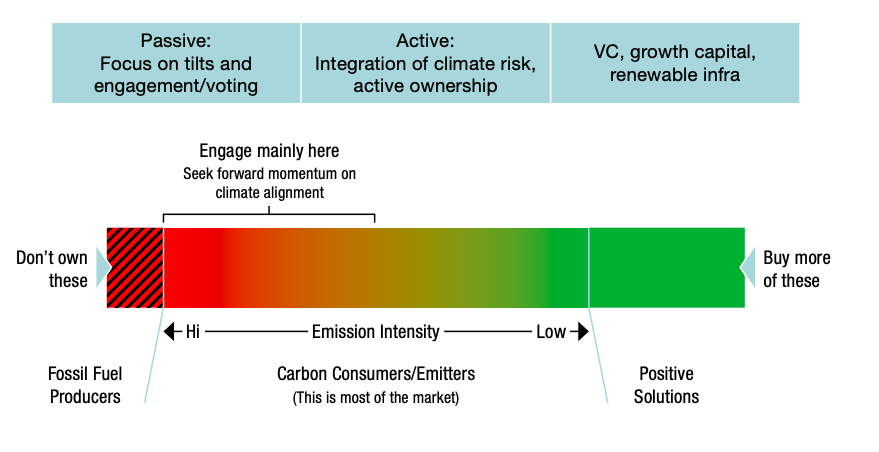

At Cambridge Associates we don’t believe in dichotomies such as ‘divest or engage?’ Different tools are right for different parts of the portfolio, to avoid bad investments, find good ones, and decarbonise the economy.

Since carbon is ubiquitous across every economy, every sector and company will need to change. Being an active shareholder – engaging – on climate topics is therefore important; if companies do not change, the Paris targets can never be met, whatever we own, or avoid, or divest

from. This means supporting climate related resolutions and voting against boards who are not delivering. This approach is appropriate for the broad range of businesses whose emissions arise from their consumption of fossil fuels, but what about the producers, the oil, gas and coal sectors?

A common argument against divestment from fossil fuel companies says that the investor loses influence which could otherwise persuade them to adopt low carbon transition plans. But how viable is it to lobby firms to plan their own run- down? The fossil fuel sector is a problem that will solve itself if the rest of the economy – its customers – succeed in making the low carbon transition. Divestment from fossil fuels is not solely an ideological position, as it is sometimes painted, but can simply be a logical and consistent investment decision. Why invest in a sector your engagement seeks to under- mine? That you hope will disappear?

Engagement and divestment alone will not protect a portfolio from the full costs of a low carbon transition, nor will they help seize the opportunities. Carbon should be treated as a business risk in all investment decisions. Asset owners should require their managers to incorporate this into their decisions, avoiding or tilting away from businesses which have high emissions or no credible plan for re- duction and searching out those with assets or technologies that can profitably eliminate emissions.

From a portfolio perspective, a lot can be achieved with modest effort. Carbon emissions are concentrated in a handful of businesses in a handful of sectors. Taking the MSCI ACWI index of global equities as an example, 22% of emissions came from only 10 companies, and in active portfolios we have found this proportion much higher, often over 75%. it is often possible to reduce a portfolio’s implied emissions dramatically by relatively modest changes.

Despite the above, it is hard, today, to build a zero-emission diversified portfolio. Significant technical challenges will have to be overcome for complete decarbonisation in some sectors; there will be a rump of very hard to avoid emissions. Purchased offsets are increasingly viewed with skepticism. Instead, it is possible to make market-return investments in, for example, renewable power, and compute with reasonable robustness the emissions avoided given the capacity ‘displaced’. This, however, is only a reasonable approach if you are making primary investments in genuinely incremental capacity. Buying existing renewable assets displaces nothing.

Asset owners who support decarbonising the economy, while protecting their port- folio from the costs of transition, need a comprehensive framework for evaluating and engaging with their investment man- agers. This can be based on the following elements of strategy:

- Divest from fossil fuel producers

- Reduce exposure to highly emitting companies

- Engage with companies to improve transition plans

- Invest in climate solutions, both technological and infrastructural

- Allow for ‘carbon avoided’ through primary investments in renewable capacity

- Monitor progress of both current emissions and their estimated pathway