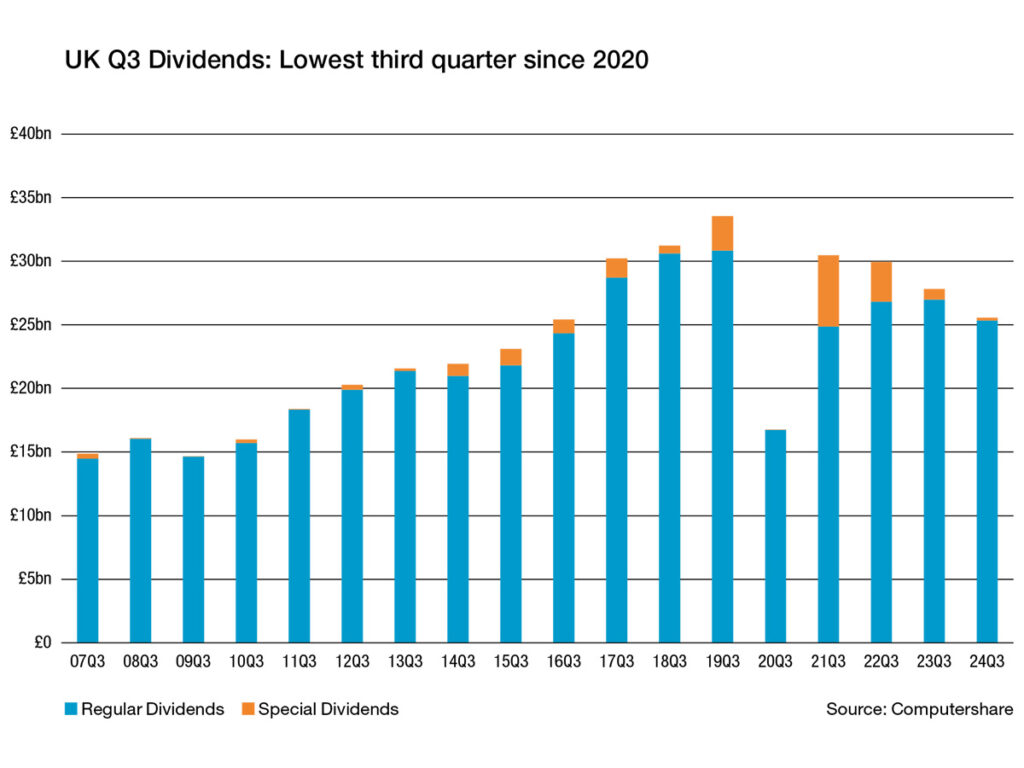

UK dividends dived 8.1% to £25.6bn in the third quarter, forcing financial services group Computershare to revise its expectations for the year.

This made it the lowest third quarter for dividends since 2020, when many companies cut their payments to preserve cash. This latest decline reflected steep cuts in the mining sector – as well as a stronger pound, unusually low special dividends and large share buyback programmes.

What is revealing within the latest data is that median growth in dividends per share was 4.5% – a little slower than in previous quarters but one that suggests growth across the wider market was better than the top-line numbers implied.

The research also showed that the biggest impact to dividend payments came from the mining sector, where payouts were £2.6bn lower than in the same period last year.

This ‘mining effect’ knocked a tenth o the third quarter’s UK-market total. If miners were excluded, underlying growth would have reached 2.6% on a constant-currency basis during the three months to the end of September.

With banking dividends broadly at and with momentum stalling in the oil sector, there were no major drivers to offset lower mining sector payouts.

Elsewhere, utilities made the largest negative impact, while the most positive contributions came from pharmaceuticals and the industrial sector.

Meanwhile, the strength of the UK economy in the first half of the year saw mid-caps outperform their blue chip counterparts by 3.6%, on an underlying basis, to -4.4%.

Therefore, Computershare has reduced its dividend forecast for the year. It now believes buybacks and exchange rates will knock £3bn off regular dividends this year, leaving UK companies to return £86.8bn to investors. This is a 0.3% decline from the 0.1% growth it forecast in July.

Comments