Before August’s market tumult arrived, equity funds attracted €15.6bn (£13.1bn) of inflows in July, while global large-cap blend equity was once more the category that saw the largest net inflows, gaining €13.4bn (£11.2bn).

Interestingly, US large-cap blend equity funds continued to be popular with European investors, according to Morningstar.

How much the market turmoil of early August will upset these numbers going forward is a moot point.

Michael Field, European equity market strategist at Morningstar, said that the August market rout was a “sharp reminder” to investors that although economic conditions are improving, equity market gains are not a given.

“Markets have since recovered, but the psychological damage done by the rout will remain for some time,” he added.

Looking at the data focused on US equities, there were some subtle but revealing changes, which experienced a notable shift away from large-cap technology stocks and a rotation to small-cap stocks, and overall, it ticked up 1.5% in dollar terms, according to the Morningstar US Market PR Index.

This potential small-cap trend could be one investors need to keep an eye on.

Meanwhile, the European market excluding UK had a more muted performance, while the UK market benefited from strong economic growth – which saw a 0.6% fillip in the second quarter – and solid service sector data.

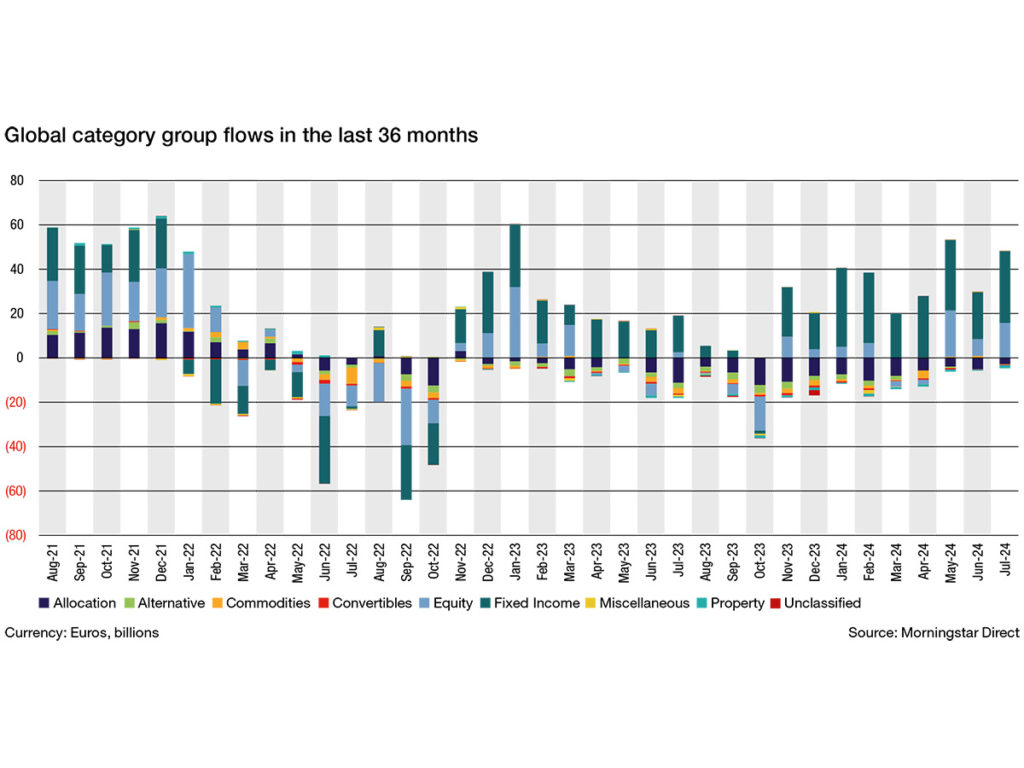

At the same time fixed-income strategies had their ninth straight month of inflows, raking in €32.3bn (£27.1bn) of inflows in July.

At the other end of the performance scale, allocation strategies marked their fourteenth month of negative flows, with €2.8bn (£2.3bn) walking out the door, bringing total outflows this year up to a whopping €43.3bn (£36.3bn).

Somewhere in between, alternatives, returned to modest positive territory after spending much of 2022, 2023 and 2024 in negative territory, flow-wise.

When it came to green funds there was a clear division in the type of green fund that remains popular – and potentially unearths a possible indication of how the green market could shape up going forward.

Funds falling within the scope of Article 8 of the Sustainable Finance Disclosure Regulation had strong inflows of €14.5bn (£12.1bn) in July.

But funds falling under Article 9, the so called ‘dark green’ strategies, continued to see massive bleeding, with a tenth consecutive month of outflows, shedding €2.8bn (£2.3bn).

Overall, Article 8 funds grew over the past 12 months, albeit by only 0.26%, while products in the Article 9 group saw a negative 4.6% rate over the same period, which raises future feasibility questions about the possible move to dark green investments.

Comments