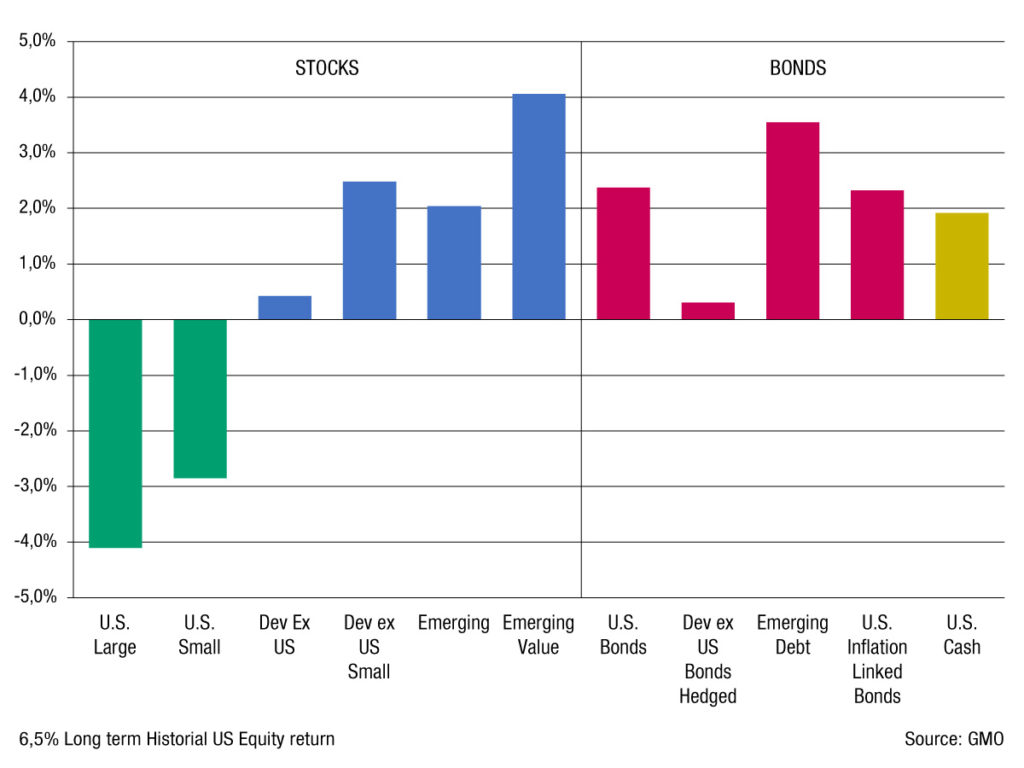

Emerging markets could offer the highest yielding stocks in the next seven years, according to asset manager GMO.

Indeed, value stocks in the developing world could return 4.1% by 2030 with emerging market equities in general expected to gain 2%.

GMO’s forecasts for value look better globally than other groups because it expects the currently cheap valuations to mean revert upwards.

Deep value – the cheapest 20% cohort – is particularly dislocated and, GMO said it is its favourite asset class today. This is evident in long-short – long deep value, short expensive growth – and long-only, investments in US and international deep value stocks.

On the debt side, the emerging world also leads the way as their bonds could offer lenders 3.5% during the same period, GMO has forecast.

Emerging bonds offer an additional credit spread over duration-matched treasuries, GMO added. At the time of writing, the spread is roughly 3.8%, broadly in-line with long-term history.

Emerging bonds further offer rich potential for alpha through security selection due to the breadth complexity of the asset class, GMO said.

The dollar is weakening again at the time of writing, after it enjoyed a strong start to the year, which could help boost emerging economies.

Cheap currencies offer an additional tailwind for emerging market equities, increasing forecasted return by nearly 2% for US investors, according to GMO.

Developed currencies such as the yen and euro are also cheap, increasing forecasted returns for developed ex-US stocks by roughly 3% for US dollar-based investors.

Equity investors can capture the tailwind of cheap currencies in two ways: the currencies could appreciate, or even if they remain cheap, there is a benefit to owning companies operating in cheap currencies – they tend to produce strong earnings growth, likely by exploiting their cost advantage.

Comments