Defined benefit (DB) schemes have the opportunity to generate a collective surplus of £500bn during the next 10 years, according to a study.

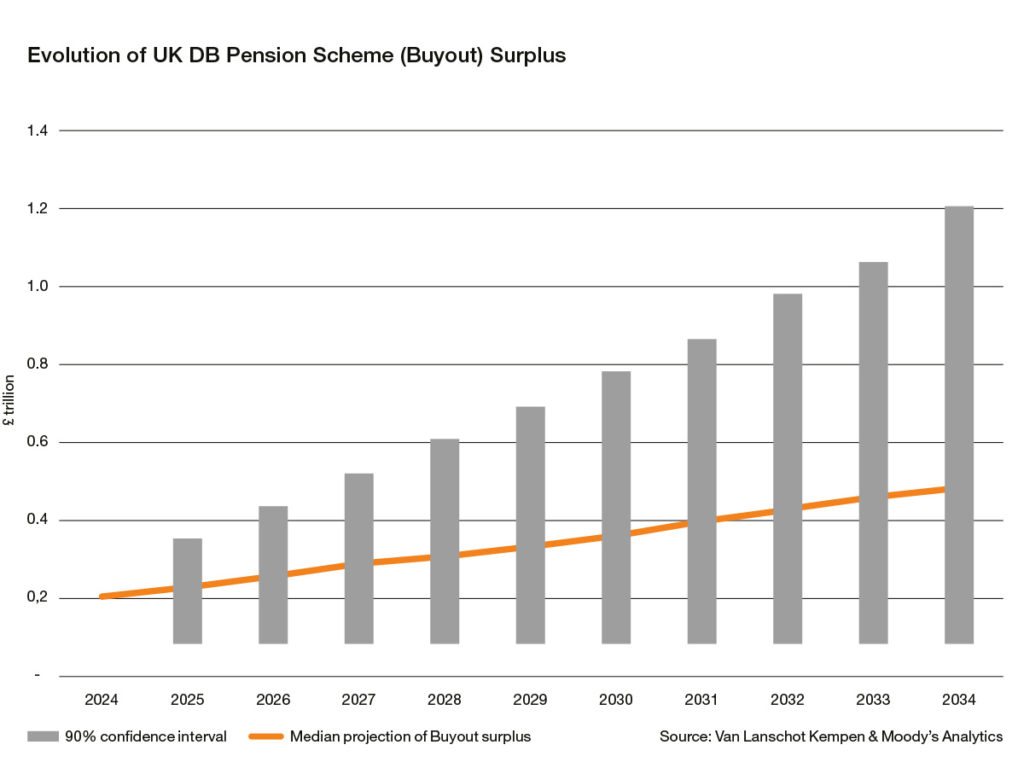

That is not all, in an extremely optimistic scenario, there is an opportunity to generate a surplus of up to £1.2trn in the next decade, according to wealth manager Van Lanschot Kempen.

The chart below shows the distribution of potential outcomes, focusing specifically on the evolution of the buyout surplus.

On average, Van Lanschot Kempen asserts schemes will adopt relatively conservative investment strategies. That is, not take on an excessive amount of investment risk, given the overall improvement in funding positions.

In the (median) base case, which is shown by the solid orange line, Van Lanschot Kempen believe there is an opportunity to generate a surplus of around £500bn during the next 10 years.

The key takeaway here is there exists great potential to generate a large amount of surplus within the UK’s final salary pensions market, even after allowing for a continuation in the significant buyout activity of £50bn per year.

This dilemma of looking to continue generating a surplus while effectively managing the risk of a deterioration in schemes’ funding positions is one that many participants in the industry now increasingly find themselves trying to address.

In light of this, there are a number of interesting run-on solutions that aim to allow schemes to keep some investment risk on the table while managing funding risk through the use of different guarantee mechanisms to protect the scheme from funding level shocks or covenant default.

This approach has three potential scenarios.

One, a buyout cost saving – by choosing to run on, trustees and sponsors can avoid having to incur the various costs associated with a buyout transaction.

Two, a greater scope to invest in ‘productive assets’ – instead of solely investing in gilts and credit, schemes would be able to continue allocating to more productive, long-terms assets such as infrastructure and private debt.

Third, there are real benefits for members and sponsors – including inflation proofing and improved benefits for DB members, as well as increased cashflow from lower DB contributions and an overall increase in shareholder value.

Comments