Matthieu Guignard is global head of product development and capital markets at Amundi ETF, Indexing & Smart Beta

The shift towards sustainability investing is one of the most revolutionary investment developments of our time. A transformation that will shape the future for successive generations, the rise of environmental, social and governance (ESG) investing is gaining momentum alongside the growth in assets allocated to exchange-traded funds (ETFs).

We are witnessing a surge in ESG investment from index management to active and beyond, with €42bn (£36bn) inflows into the European ESG ETF market in 2020 versus €17bn (£14.7bn) in 2019.1 To explore this increasing demand for ESG ETFs and understand what is driving ESG allocation decisions, Amundi commissioned a survey of 171 professional investors from across Europe.

ESG ETF allocations rising

ETFs are an ideal, low-cost way for investors to diversify their portfolios. Allocating assets to ESG-focused ETFs gives investors exposure to stocks that contribute towards positive impact, or exclusion of those that have negative impacts. ESG ETFs in Europe accounted for 51% of total ETF flows in 20202 and our survey showed that 69.7% are planning to increase their allocations towards ESG ETFs within the next year.

Matching investment exposure to values

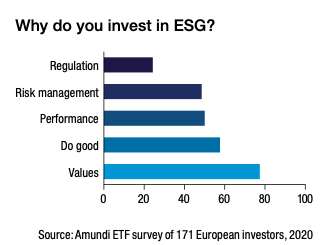

Aligning investments with personal or corporate values stood out in the survey as the primary reason for investors allocating assets to ESG (77.3%).

The typical ETF selection criteria seems less critical for investors when selecting an ESG-focused product with ESG intensity ranking higher than the index provider and the asset manager’s ESG expertise, confirming the importance of developing solutions to match investors’ differing needs, values and constraints.

Considering climate

Our survey found that 74.2% of respondents had considered climate within their portfolios and 64.9% said they want to align with the goals of the Paris Agreement.

As a leader in the transition towards ESG, Amundi became one of the first issuers offering exposure to The European Union

Paris-Aligned Benchmark (PAB) and Climate Transition Benchmark (CTB) indices in 2020.

Engagement drives sustainable change

ESG ETFs can be criticised for having little to no stewardship with limited ability to influence change within the companies to which they are exposed. However, passively managed assets have the same voting rights as active, and many passive managers are among the world’s largest active managers. Investors can seek a manager with the in-house expertise and resources to vote on shareholder resolutions.

Close to 80% of survey respondents believed that voting and engagement was very relevant or essential, and nearly half of survey respondents confirmed they would not invest in an ESG ETF from an issuer that did not consider ESG in its voting policy.

ETFs have a key role to play in democratising ESG investing, redirecting capital for good, and empowering all investors to have an impact in a way that suits their needs and goals. To learn more about Amundi’s comprehensive range of sustainable ETFs, visit amundietf.co.uk/esg

1), 2) Source: Amundi, 2021